Most Popular

-

![7 Scriptures to Help with Nightmares]() 7 Scriptures to Help with Nightmares

7 Scriptures to Help with Nightmares -

![A Prayer for Safe Travels - Your Daily Prayer - April 17]() A Prayer for Safe Travels - Your Daily Prayer - April 17

A Prayer for Safe Travels - Your Daily Prayer - April 17 -

![Jesus Feeds the 5000: 5 Miraculous Truths for Today]() Jesus Feeds the 5000: 5 Miraculous Truths for Today

Jesus Feeds the 5000: 5 Miraculous Truths for Today -

![31 Powerful Morning Prayers to Start Your Day Encouraged]() 31 Powerful Morning Prayers to Start Your Day Encouraged

31 Powerful Morning Prayers to Start Your Day Encouraged -

![7 Ways God Uses Waiting to Prepare You]() 7 Ways God Uses Waiting to Prepare You

7 Ways God Uses Waiting to Prepare You -

![A Prayer for the Door That Was Closed - Your Daily Prayer - April 18]() A Prayer for the Door That Was Closed - Your Daily Prayer - April 18

A Prayer for the Door That Was Closed - Your Daily Prayer - April 18 -

![How Do We Know if God Has a Sense of Humor?]() How Do We Know if God Has a Sense of Humor?

How Do We Know if God Has a Sense of Humor? -

![7 Sneaky Idols Destroying Christian Marriages Today]() 7 Sneaky Idols Destroying Christian Marriages Today

7 Sneaky Idols Destroying Christian Marriages Today -

![Criticized Men's Conference Showman Responds to Mark Driscoll, Says He Is a Christian]() Criticized Men's Conference Showman Responds to Mark Driscoll, Says He Is a Christian

Criticized Men's Conference Showman Responds to Mark Driscoll, Says He Is a Christian -

![6 Reasons We Can Believe in the Resurrection of Jesus Christ - Your Daily Bible Verse - April 18]() 6 Reasons We Can Believe in the Resurrection of Jesus Christ - Your Daily Bible Verse - April 18

6 Reasons We Can Believe in the Resurrection of Jesus Christ - Your Daily Bible Verse - April 18

The Latest

Today's Devotional

Pursuing the Kingdom of GodIf you are Christian, then you are born again. And if you are not born again, then you are not a Christian.

Today's Bible Reading

Acts 8:26-40; Joshua 1-2; Job 21Today's Trending Headlines

- Criticized Men's Conference Showman Responds to Mark Driscoll, Says He Is a Christian

- Record 12,000 People Baptized in France on Easter Sunday

- International House of Prayer to Close University, Reorganize Amid Abuse Allegations

- Heartbroken Parents Are Blindsided as They Find Themselves Saying Goodbye to 15-Month-Old

- Israeli Archaeologists Unearth Building Linked to Figure in 2 Kings

Crosswalk Recommends

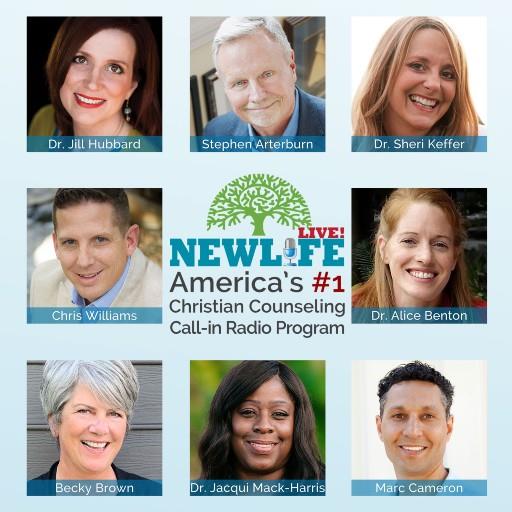

New Life Live: April 19, 2024

Listen to Steve Arterburn now on OnePlace.com

Around the Web

.jpg)

%20(2).jpg)