Finances

Financial Planning

-

![3 Principles of Financial Planning God’s Way]() 3 Principles of Financial Planning God’s Way

3 Principles of Financial Planning God’s Way -

![What Does the Bible Say about Minimalism?]() What Does the Bible Say about Minimalism?

What Does the Bible Say about Minimalism? -

![Surprising Ways to Help College Students Thrive]() Surprising Ways to Help College Students Thrive

Surprising Ways to Help College Students Thrive -

![Biblical Tithe: It’s More (and Less) Than You Think it Is]() Biblical Tithe: It’s More (and Less) Than You Think it Is

Biblical Tithe: It’s More (and Less) Than You Think it Is - More Financial Planning Articles

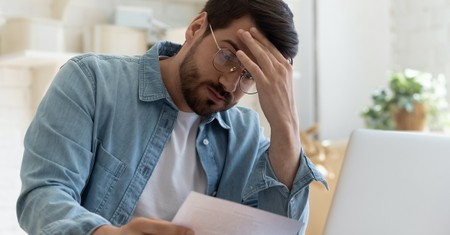

Debt

-

![7 Ways to Stay Motivated to Get Out of Debt]() 7 Ways to Stay Motivated to Get Out of Debt

7 Ways to Stay Motivated to Get Out of Debt -

![Stop Leaking Money! 21 Overlooked Ways to Save]() Stop Leaking Money! 21 Overlooked Ways to Save

Stop Leaking Money! 21 Overlooked Ways to Save -

![5 Simple Steps to Start Getting Out of Debt]() 5 Simple Steps to Start Getting Out of Debt

5 Simple Steps to Start Getting Out of Debt -

![How Small Victories Win the War against Debt]() How Small Victories Win the War against Debt

How Small Victories Win the War against Debt - More Debt Articles

.jpg)