Do You Understand the Math of Dividend Reinvesting?

In How Ultra-Short Term Bonds Can Help Boost an Emergency Fund, we reviewed how to boost the returns you get on your emergency fund by using ultra short-term bond funds. Savers willing to hold such funds for at least one year are quite likely to obtain better returns than with money market funds. Similarly, we’ve also looked before at short-term bond funds for those with a time horizon of two years or more.

Short-term bonds represent a step up the risk/reward ladder. During periods of rising interest rates, they can show small losses. Investors often think, however, that the results in their short-term funds are worse than is actually the case. That's because they focus exclusively on the price per share of their fund, failing to take their monthly dividends into account.

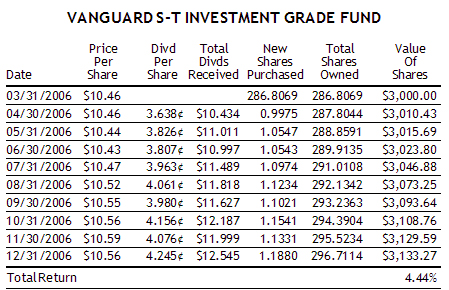

Consider the table above which shows the price and dividend information for the Vanguard Short-Term Investment-Grade bond fund during the final nine months of last year. (This is one of the bond funds recommended regularly in the Sound Mind Investing newsletter for your emergency fund investments.) If $3,000 was invested at the end of March 2006, an investor would have acquired 286.8069 shares. After nine months, with the fund closing in December at $10.56 per share, it appears at first glance that profits have been slight. A ten cent gain in share value equates to a return of less than one percent.

This overlooks, however, the fact that the fund pays monthly dividends to its shareholders. Since these dividends are paid from the assets in the fund, typically on the last business day of the month, they are deducted from its net asset value at that time. This reduces the share price as shown in the newspaper that day. The Vanguard fund paid 3.638¢ per share at the end of April, 3.826¢ at the end of May, and so on.

Most savers sign up to have their dividends reinvested in more shares. In our example, the April 30 dividend totaled $10.434 (3.638¢ per share times 286.8069 shares). Since the fund closed at $10.46 on that date, the dividend was almost able to purchase a full additional share (0.9975 to be exact). As a result of this reinvesting process each month, our investor's account grew to 296.7114 shares by the end of the year. When this is multiplied by the December 31 closing price of $10.56 per share, the investment is shown to have grown to $3,133.27. This equates to a 4.44% nine-month total return rather than the meager gain that it first seemed. This is equivalent to a 5.96% return on an annualized basis.

If you're building an emergency or accumulation fund, perhaps it's time you take a look at the kinds of bond funds we've been discussing. They won't outperform money market funds every month, but you'll likely be pleased when you make year-to-year comparisons.

© Sound Mind Investing

Published since 1990, Sound Mind Investing is America's best-selling financial newsletter written from a biblical perspective. Visit the Sound Mind Investing website.

Originally published June 20, 2007.