Should Christians Buy Life Insurance?

We live in a day and age where planning is an afterthought. We get what we can out of today without a thought about tomorrow. Whether it is greedy politicians doing whatever they can to hold on to their power by whatever means necessary and without concern for future generations, or young people living for pleasure today without ever thinking about their bodies or bank accounts in retirement, the world has a habit of neglecting the future. The clearest example of that is the fact that no one thinks about the day that they will stand in front of their Maker at the judgment.

Christians ought to be different. Obviously, we should be longing for heaven above all things, but we should be making decisions in a way that prefers others. There are few things in life that display more of a selfless mentality than caring for the people who our Sovereign God has placed in our lives even after we are dead.

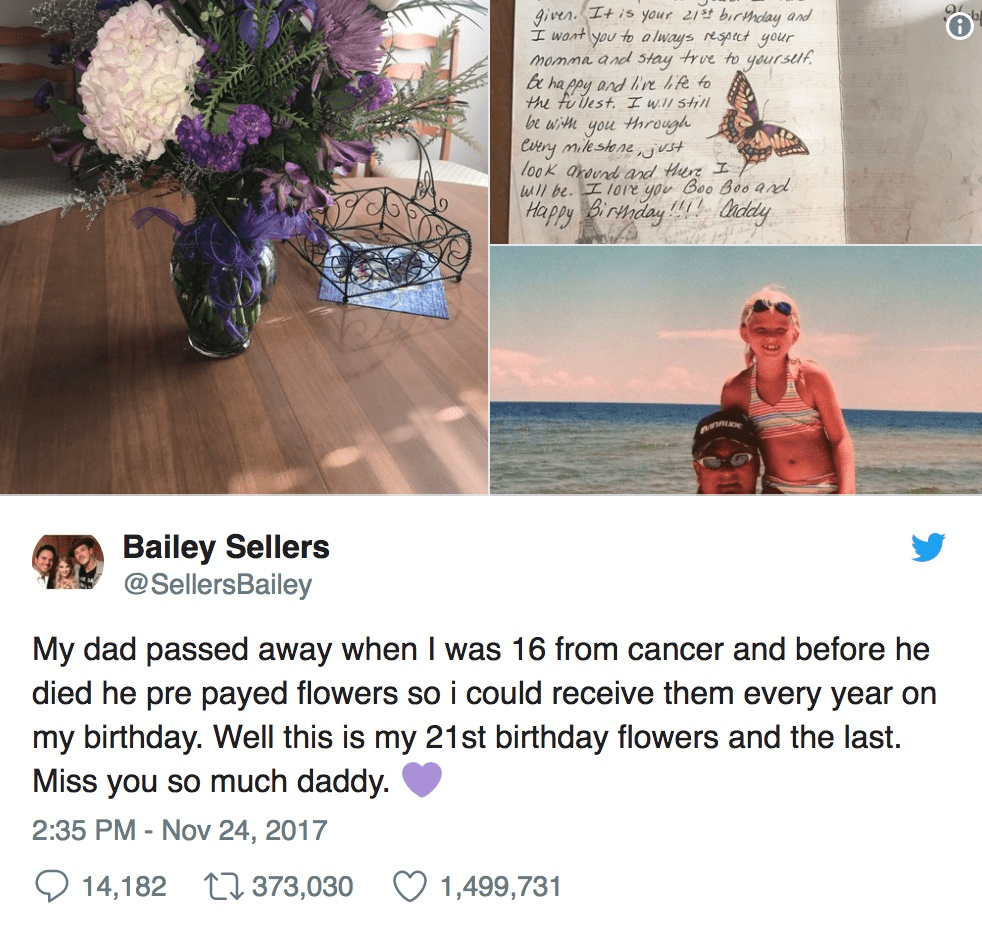

Recently a young woman tweeted out a picture of a letter and flowers she received from her dad on her 21st birthday, 5 years after her father had died.

Here’s a man who, in his last days, thought, ” I’d like to care for my daughter for the next few years.” He selflessly put aside his own interests and thought about his daughter instead.

This reminded me of the importance of life insurance. It is incredible how many Christian fathers, and especially men in ministry, do not have life insurance. There are many reasons to buy life insurance, but here are three that I think are important for us to consider as believers.

It is a practical way to deny ourselves.

There are few more practical ways in this life that show that you care about your family more than yourself than by buying life insurance. Some people think it is too expensive, but a quick look at our bank account statements will show that we waste money all the time. Whether it is TV packages, Starbucks, or eating out, there are countless things we can do to make sure we have enough money to be able to care for our wife and children’s future.

As the Bible commands us in Philippians 2:4, we are not to “merely look out for your own personal interests, but also for the interests of others.” There are few things in this life that put this verse into practice better than providing for people once you are gone.

It is a practical way to show that we do not presume on God.

Few people ever consider the fact that they might die, and, as rare as it is for someone to die young, it happens more often than you think. As believers, we are called to long for Heaven.

Jesus, in His high priestly prayer, literally prays for our death and proves that He is looking forward to our death so that we get to be with Him for eternity. Paul often thought of his death, to the point where he was ready to declare that death was gain. One of Jonathan Edwards’s resolutions was to be regularly thinking about his death and how it may occur!

It is presumptuous for us to think that we will live past today. God may have ordained for today to be your last day on earth, so you must ask yourself, “If I were to die today, will anyone under my care be provided for?”

Planning for the future is not a sin, but pridefully assuming that your plans will certainly go through the way you imagined is (James 4:13-16).

It is a practical way to be the protectors and providers for our families.

The Bible tells us that those who do not provide for their family are worse than unbelievers (1 Timothy 5:8). Of course, this verse isn’t only talking about money, so we must be careful in how we apply it, but it is calling husbands to care for their families and fathers and mothers to care for their children not only in a spiritual way but also in a physical one. The Bible also calls us to care for the orphans and the widows (James 1:25-26). Your wife and children are literally going to be orphans and widows upon your death. It is your duty to care for those God has entrusted in your care and it is a neglect of duty to leave them without provision.

A few people have told me recently that they don’t have life insurance, and most of the people I’ve talked to while they were still engaged had never even considered life insurance before. I still remember my seminary professor asking our class how many of us had life insurance and less than 10 percent of the people in our class raised their hands. It was something I had never considered before that moment. I’m sure that there are many others out there who are currently in that same position. Of course, some of you reading may have tried and were denied, and others simply cannot afford it, but the vast majority of us do not have that excuse.

Believe it or not, I’m not an insurance salesman, nor do I ever imagine myself to be one, but it is something that, with each passing year, becomes more and more obvious for anyone, male or female, who has dependents in their care.

A few years ago a pastor friend of mine, who was living with a serious disease, recorded videos for all his kids to watch on their 16th birthday. This man, who had peace about dying despite the fear he may personally face, was more concerned with the ones he was leaving behind and took the time to record videos for each of them. Perhaps we’ll get the chance to do something similar, perhaps we might die suddenly without warning, but we all can provide for our families when we die.

P.S. As I said, I’m not an expert on insurance; all I know is that you should run away from whole life insurance and get term-life instead. I’ve found Dave Ramsey to be helpful in this area. Here’s an article he wrote on the topic that you will find helpful.

This article was orginally published on The Cripplegate. Used with permission.

Jordan Standridge is a pastoral associate at Immanuel Bible Church in Springfield, VA, where he leads the college ministry. He is the founder of The Foundry Bible Immersion.

Photo courtesy: ©Thinkstock/scyther5

Originally published September 03, 2018.