4 Principles Your Kids Should Know about Money

I’ll never take for granted the lessons my parents taught me about money when I was a kid.

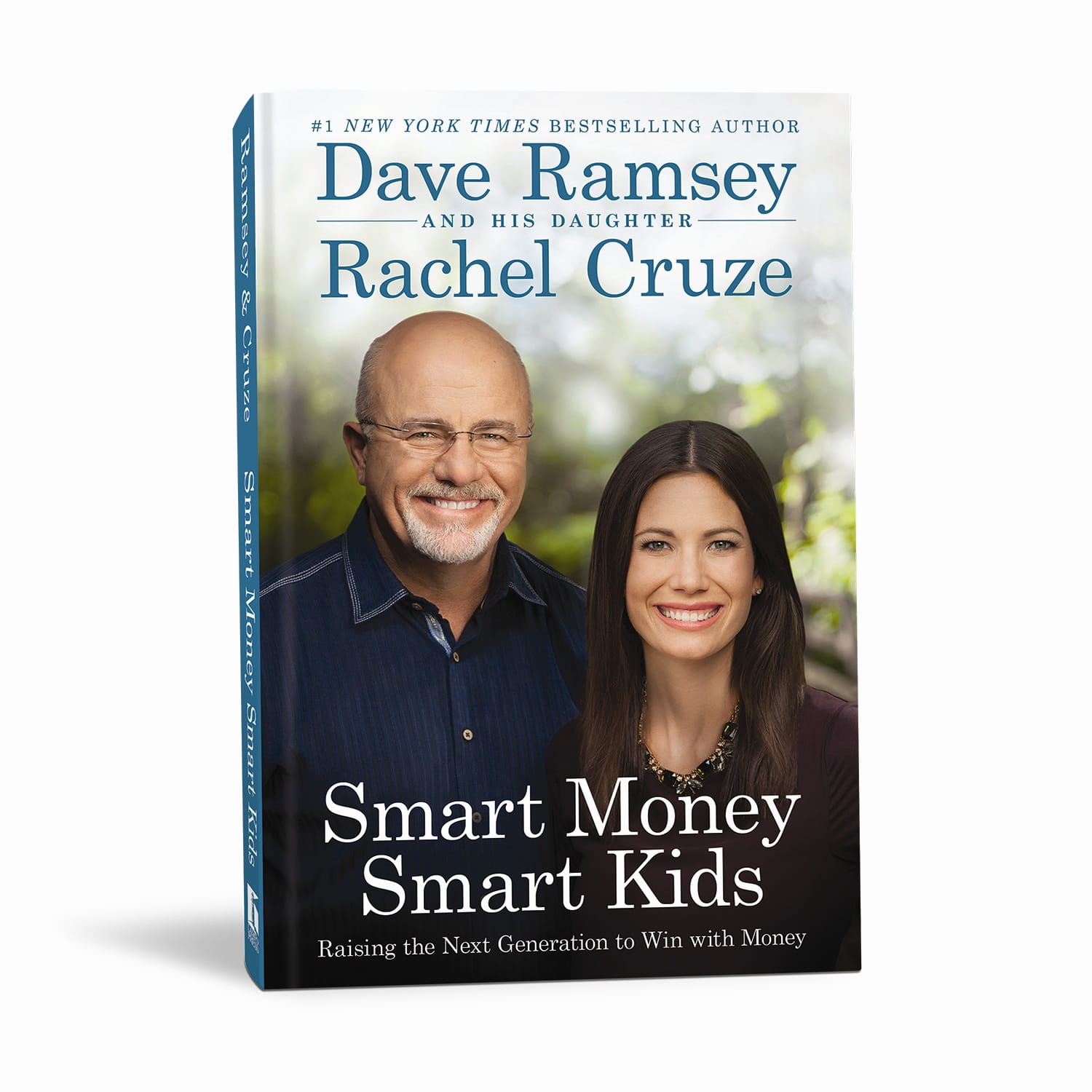

Because they didn’t want me to make the same mistakes they made, they began teaching me the basic principles of money at an early age. My mom was great about taking me shopping and helping me understand the relationship between money and stuff—and those lessons were the inspiration for my new book, Smart Money Smart Kids, that I co-authored with my dad, Dave Ramsey.

Here are a few tips my parents taught me that may help you in teaching your children how to win with money.

Stuff costs money. As adults, we take this simple truth for granted. But do your kids realize what it means to pick up three toys at the toy store and pay for them at the register? Has it “clicked” yet?

As a kid, I remember seeing my mom pay for groceries with a $100 bill. I was shocked! $100? On food? I had a difficult time wrapping my brain around that. But eventually, after a few more trips to the grocery, I got it. Stuff—food, clothes, and even toys—costs money.

What’s the “opportunity cost”? That’s a fancy phrase that you don’t need to say to your kids. But opportunity cost is basically this: You have $5 to spend. So if you buy this $4 toy truck, you can’t buy the $3 action hero figurine.

It’s all about priorities. When your kids understand that money is limited, they’ll be able to begin making basic informed decisions—like, do I really want that video game more than a new baseball bat?

Mistakes are okay. As your kids grow into teenagers, it’s okay to let them stumble and fall with their money decisions every now and then. After all, you’d rather them make a mistake over a $20 game now than a $10,000 car ten years from now.

Teach them, guide them, and make sure they still follow your rules, but also let them feel the power (and burden) of being financially responsible.

Honesty is the best policy. It’s a cliché, but it’s true! I wouldn’t be where I am today if my parents hadn’t been honest with me about their success and their failures. From an early age, I knew my parents had gone bankrupt, and I understood how that affected our lives moving forward.

If my parents chose to keep their bankruptcy a secret and not talk to me about it, I wouldn’t have gained anything from all the lessons they learned. Not only that, but I would have probably made the same mistakes!

As a parent, it’s your responsibility to teach your kids about money. Don’t let them grow into adults who don’t understand these basic principles.

Photo courtesy: ©Unsplash/Damir Spanic

Originally published April 25, 2024.